Can a remodel benefit my taxes? How to get deductions from your renovation

When it comes to taxes, every deduction counts. While home remodels usually don’t have tax deductions, there are certain remodels that will fit the criteria. Remodeling can help your taxes when buying or selling your home. Here’s how you can minimize your taxes with a home renovation.

How to Minimize Your Taxes with a Home Renovation

Include the Renovation Budget in Your Mortgage

One way to minimize your taxes with a home renovation is to include the renovation budget in your mortgage loan. This allows you to take advantage of the tax deductions available for home acquisition debt. To qualify for home acquisition debt, the loan must be secured by your home and the proceeds must be used to buy, build, or substantially improve your home. By including the renovation budget in your mortgage, you can make sure that the loan qualifies for home acquisition indebtedness and thus qualifies for an IRC Sec. 163 deduction.

It is important to note that the Tax Cuts and Jobs Act (TCJA) has placed limits on the amount of home acquisition indebtedness that can be deducted. Under the TCJA, the limit on home acquisition indebtedness is $750,000 for married taxpayers filing jointly and $375,000 for married taxpayers filing separately. These limits apply to loans taken out after December 15, 2017.

Home Equity Line of Credit (HELOC)

Another way to finance a home renovation is through a Home Equity Line of Credit (HELOC). A HELOC allows you to borrow against the equity in your home to pay for the renovation. However, it is important to note that the interest on a HELOC is not tax-deductible unless the loan is used to buy, build, or substantially improve the home that secures the loan. This means that if you use a HELOC to finance a home renovation, the interest may be tax-deductible if the renovation qualifies as a substantial improvement.

See also: Smart Strategies for Staying on Budget During Your Bathroom Remodel

Make improvements that are medically necessary

Another way to minimize your taxes with a home renovation is to make improvements that are medically necessary. Home improvements that are deemed medically necessary, such as adding wheelchair ramps or widening doorways, can be tax-deductible. This can help you save on your taxes while also improving the accessibility and safety of your home.

Pro Tip

If you are an older adult, you may want to consider making modifications to your home that will allow you to age in place more comfortably. There are many ways to make your kitchen, bathroom, and other rooms more suitable to your needs. Read our post to learn how you can revamp your kitchen to successfully age in place.

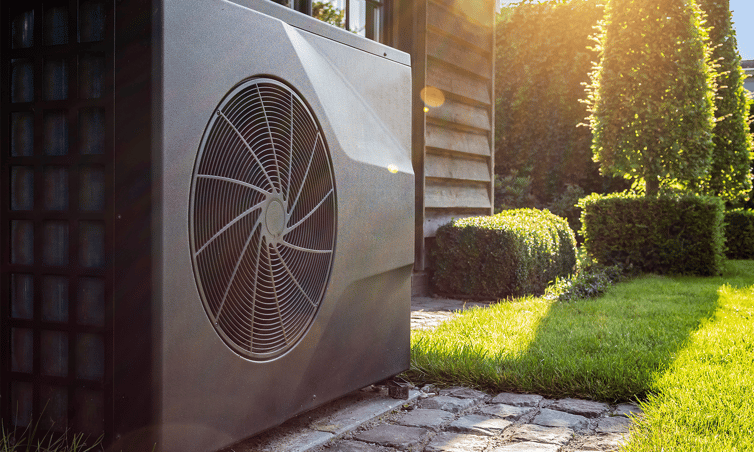

Make your home more eco-friendly

Making your home eco-friendlier can also help you minimize your taxes. Certain eco-friendly changes, such as installing solar panels or geothermal heat pumps, may qualify for tax credits. These tax credits can help offset the cost of the improvements and reduce your overall tax bill.

Reduce your taxes when selling your home

When it comes time to sell your home, certain remodels can help reduce your taxes. Remodels that increase the value of your home can help improve your capital gains position when you sell. This can help reduce the amount of taxes you owe on the sale of your home.

Get the most from your remodel with Innovative Home Renovations

When you partner with Innovative Home Renovations, you’ll have access to an experienced team that will help you design and finance your remodel to harness the greatest number of benefits possible.

If you want to upgrade your Seattle home, our design-build firm will deliver the best results with the least stress on your plate. Contact us today to begin a remodel that is on-schedule, on-budget, and will bring you benefits for years to come.

This blog was provided by Kim Martin, CPA – owner of MAS Inc – Certified Public Accountants.

Kim is the managing partner of MAS. The firm is located in Edmonds, WA. MAS is a full-service CPA firm, providing tax, accounting and business advisory services to businesses and individuals. We understand how busy you are, and with our expertise we can take care of your accounting needs, leaving you to worry less and live more. https://www.mascpas.com/

by Kimberly S. Martin, CPA